Tip: Activate javascript to be able to use all functions of our website

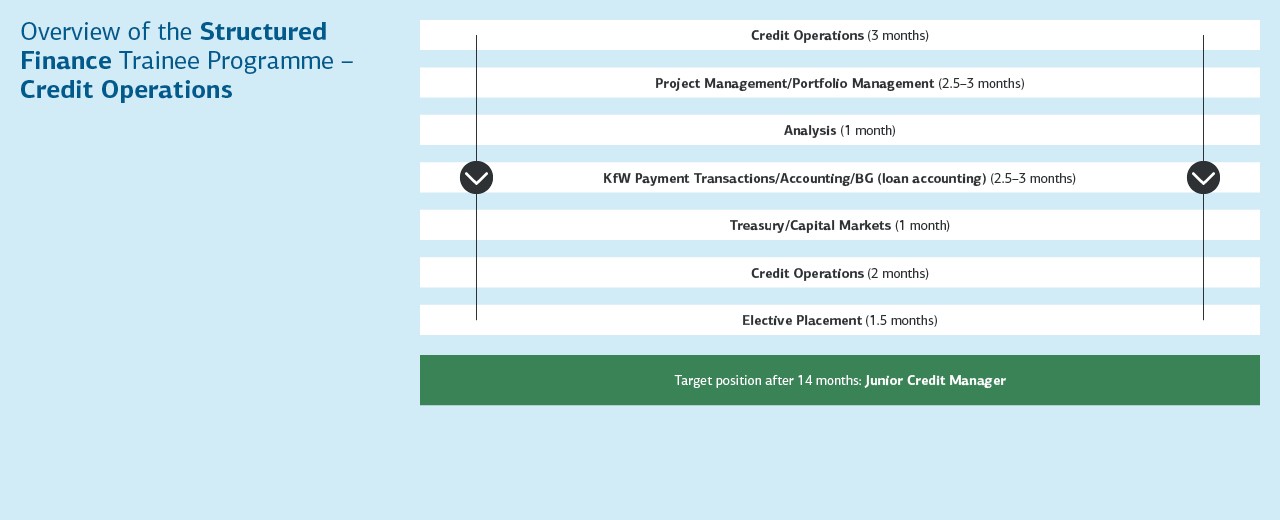

Do you focus on international payment transactions and enjoy getting to the bottom of complex financing structures – and translating them correctly into IT systems? Are you interested in reviewing currency options, defining interest rate conditions and being responsible for the clear-cut administration of loans issued worldwide as a central point of contact for your colleagues as part of transaction management? Then we will prepare you for your desired position with our 14-month Structured Finance Credit Operations trainee programme, where you can use your financial acumen in a targeted manner in extensive financing projects.

The insights you gain into your future field of work during your 14-month trainee period are comprehensive, intensive and varied. As a graduate trainee, you will go through numerous departments and sectors, get to know the tasks, processes and people there, understand the interrelationships and thus gain a good overview of our business.

After successfully completing your trainee programme, you will take on a permanent role in one of our credit management teams, organised by industry and transport sectors. As a junior credit manager, you are responsible from day one for contract entry, valuation and administration of the credit exposures you manage. The bank’s backbone: with the complete mapping of the complex financing structures in our IT systems, you will ensure that the items are correctly shown later in the balance sheet.

“I’ve always enjoyed working with numbers and Microsoft Excel and it’s a key part of my current trainee programme. After studying Business Administration in Münster, I had the opportunity to gain in-depth insight into the activities of Credit Operations through a case study. This experience not only gave me a good idea of the challenges and opportunities in this area, but also motivated me to start the trainee programme at KfW IPEX-Bank.

Credit Operations is the backbone of international business. In the early phase of transactions, we advise the front office departments on questions regarding the mapping of credit structures and agency mandates. Here, a sharp eye for figures is crucial for accurately analysing and presenting financial structures. As the transactions progress, the Payments and Credit Transactions team takes responsibility for the commitment letters and loan agreements and ensures that all relevant information – including balance sheets, registration systems and risk management processes – is correctly mapped in the IT systems. In order to define, request and book all payment flows, a good understanding of the figures is also essential to manage the complexity and identify potential risks at an early stage.

I appreciate the excellent networking among the graduate trainees, which promotes exchange and cooperation. This close cooperation allows us to learn from each other and gain different perspectives. Regular meetings and joint projects not only strengthen the team spirit, but also help to build a strong network within the bank. This dynamic contributes to a pleasant working atmosphere, even under time pressure.

KfW IPEX-Bank is the right place for anyone looking for exciting and challenging tasks in International Credit Operations and who likes to solve them as part of a team."

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw-ipex-bank.de/s/enxBi_3Z

Copy link Link copied