Tip: Activate javascript to be able to use all functions of our website

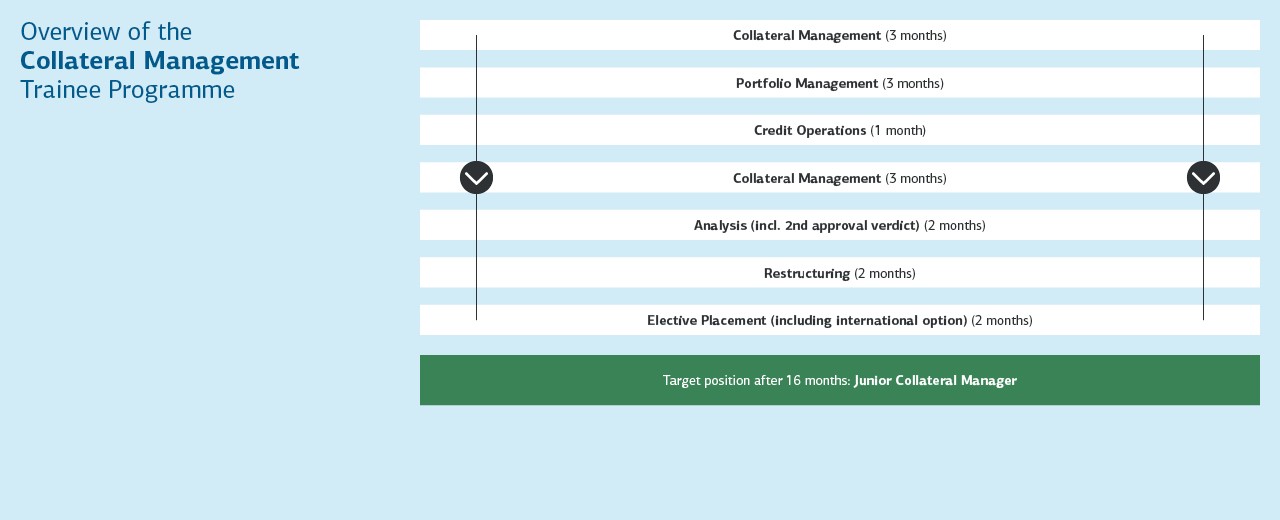

Do you have a natural sense of risk and want to use and develop this talent professionally? Are you interested in taking a close look at international contract texts and designing them to be watertight with your sharp eye for security-relevant aspects? Collateral management ensures that everything runs smoothly in the event of an incident. Sounds good to you? Then start your banking career with our 16-month Collateral Management trainee programme. From day one, we’re counting on you to help protect our bank.

The insights you gain into your future field of work during the 16-month trainee period are comprehensive, intensive and varied. As a graduate trainee, you will go through numerous departments and sectors, get to know the tasks, processes and people there, understand the interrelationships and thus gain a good overview of our business.

After successfully completing your trainee program, you will take on a permanent role in our Collateral Management specialist team. As a junior collateral manager, you now independently manage your own portfolio of loan collateral – from the regular assessment of the value of the assets to the legal review of the agreed conditions and new business.

Does our trainee programme specialising in collateral management at KfW IPEX-Bank look perfect for you? Then take a look at our job openings to find out which trainee opportunities we have at present.

“I completed my traineeship in Collateral Management. We take care of loan collateral for our financing agreements – such as real estate, ships, trains, airplanes and accounts. The collateral is transferred to the bank to protect it against payment defaults. If the repayment of a loan stops, the collateral can be used (sold) instead. I chose the programme because I also have a private interest in asset valuation as well as shares and cryptocurrencies.

In our team, we initially take over the collateral from Execution & Portfolio Management. In doing so, we deal intensively with the underlying loan/collateral agreements and record them in our system. We need to be very precise in this, because we must not miss anything in the contracts, and all the figures must be exact. Teamwork is necessary, because we work according to the dual control principle. A certain interest in legal issues is helpful for the tasks.

Apart from the normal day-to-day business, there are many exciting special tasks. I personally deal with the real estate asset type and would like to highlight some of my special tasks so far.

Validation of appraisals: We receive detailed reports at regular intervals for all properties in our real estate portfolio, which is spread across several countries (mainly Germany, the Netherlands and the United Kingdom). These come from external experts with whom we are in close contact. We deal in detail with the appraisals, which also include pictures of the property, and check the plausibility of the value information contained therein.

Market analyses: Here we are dealing with the concept of market fluctuations. This analyses changes in value (positively and negatively) of different property types in all regions of Germany. These average fluctuations can be applied to your own real estate portfolio in order to anticipate impending relevant declines in value.

ESG: We are working on the transformation of the real estate market with the help of various tools. The aim is to also make this asset class future-proof from the point of view of improving environmental impact.

In general, I had not dealt with collateral before. I am now working in an exciting field in the risk management department. I learned a lot from my nice colleagues, who are keen to share their knowledge. In general, I can say that I feel very comfortable at KfW IPEX-Bank, also because of the general conditions. The salary and work-life balance are very good, there are attractive employer benefits and the corporate culture is also great. I particularly like lunch dates with my colleagues.”

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw-ipex-bank.de/s/enxBjDtH

Copy link Link copied