How we finance the future

Business development in 2020

The spread of COVID-19 exposed all countries and their economies to unexpected challenges during the reporting period, with many companies opting to proceed with utmost caution in the face of uncertainty. The impact on the global economy was felt throughout 2020, although individual economies, particularly in the Asian region, returned to strong growth at the end of the year. Economic growth was also affected by the UK's pending disorderly exit from the EU and the outcome of the US presidential election – but the dominant topic remained the spread of COVID-19.

Demand for financing

Demand for capital goods financed by KfW IPEX-Bank reacted accordingly. Whereas, at the outset of the coronavirus crisis, many companies tried to secure liquidity and prioritise financings with a liquidity-securing effect, they later showed a marked reluctance to invest, especially in hard-hit countries and sectors. In this market environment, KfW IPEX-Bank's focus was on supporting longstanding customers to further expand their business internationally and on borrowers with good credit ratings. At the same time, it helped its customers overcome the challenges posed by coronavirus, for instance by restructuring or refinancing existing projects. Thanks to KfW IPEX-Bank's focus on future technologies, operations were stable, bucking the general trend. In the reporting year, for example, financing of infrastructure projects, particularly in digital infrastructure, saw greater demand.

However, KfW IPEX-Bank experienced declining demand in sectors related to tourism and passengers, with demand for financing of cruise ships and aircraft falling noticeably, whereas rail-based transport projects remained largely unaffected. Financing for commodity projects, on the other hand, was often postponed and less frequently pursued in the past year.

Despite these challenges, KfW IPEX-Bank provided financing totalling EUR 16.6 billion in 2020. Although new commitments were well below the previous year's record of EUR 22.1 billion, they remained at a similar level to preceding years (e.g. 2018: EUR 17.7 billion). In most cases, KfW IPEX-Bank acted as a partner in club or syndicate financing arrangements with other national and international banks.

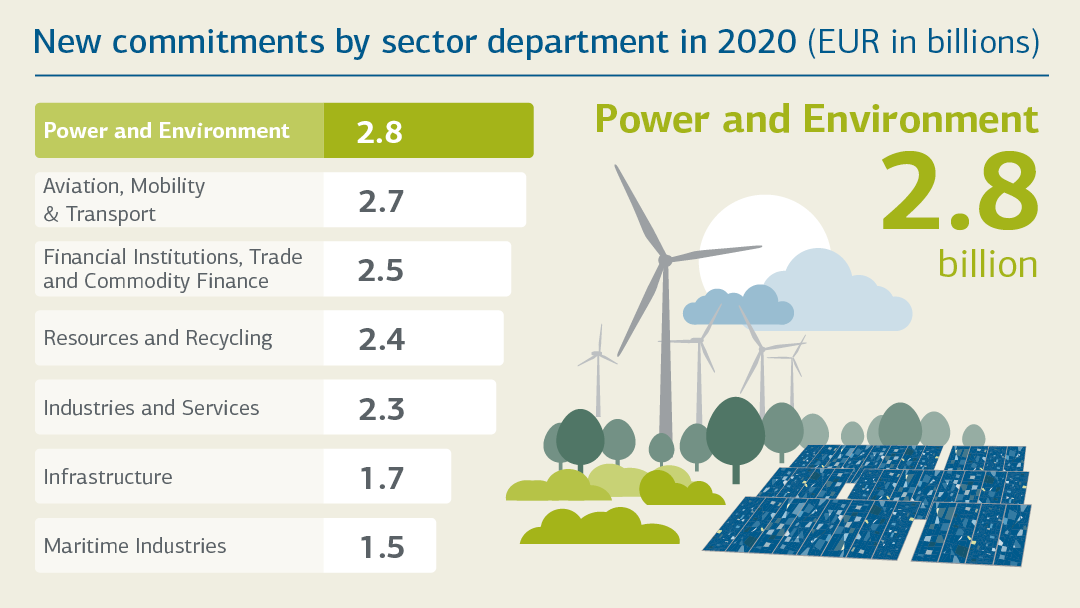

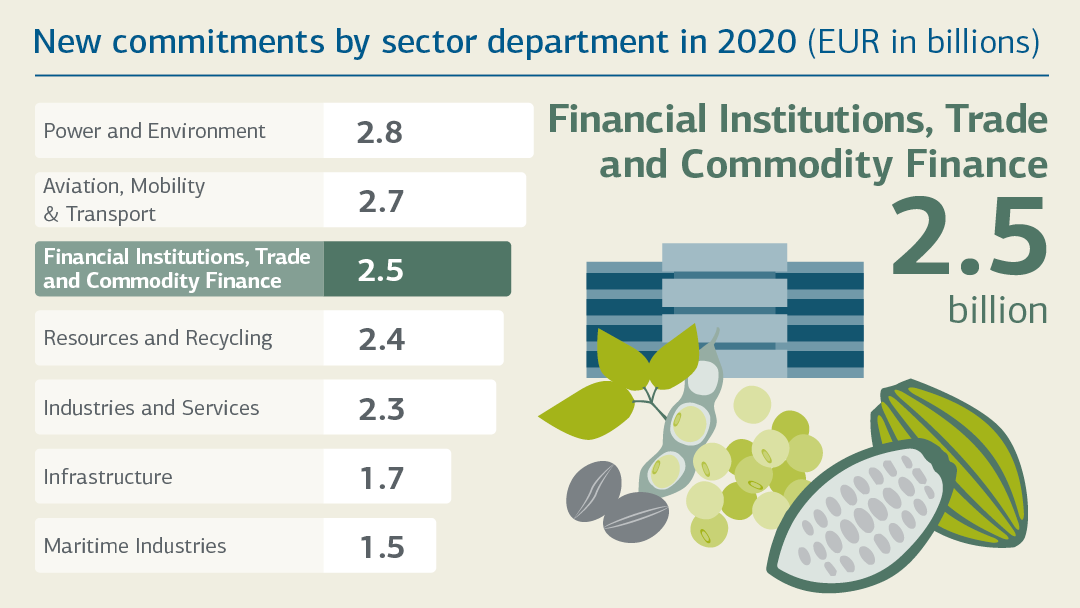

New commitments by sector department

EUR 15.9 billion (2019: EUR 18.6 billion) of new commitments related to original lending business and EUR 0.7 billion (2019: EUR 3.5 billion) to funds for bank refinancing under the CIRR ship and ERP export financing schemes. In this respect, KfW IPEX-Bank acts indirectly on behalf of the Federal Republic. EUR 13.8 billion in new loans were attributable to KfW IPEX-Bank's market business, while EUR 2.8 billion constituted trust business performed on behalf of and for the account of KfW (including CIRR).

All of KfW IPEX-Bank's sector departments made an important contribution to the bank's result in 2020. The Power and Environment sector department posted the largest volume of new commitments at EUR 2.8 billion, providing a large proportion to projects relating to energy transition, such as onshore and offshore wind farms. These projects underline the bank's ambition to support global climate policy goals by increasing financing for environmental protection and climate action measures, because, wherever in the world the use of renewable energy is expanded or measures to improve energy efficiency are implemented, this has a positive impact on the global climate.

New commitments for digitalisation projects also stood out in 2020. Whether people work from home, communicate with family and friends or do the shopping, it is clear – in these times of coronavirus – how heavily economic and social life relies on a resilient digital infrastructure. KfW IPEX-Bank provided support of approximately EUR 800 million for financing fibre, broadband and mobile network expansion and the construction of sustainable data centres.

Responsible action

KfW IPEX-Bank plays an active role in driving the transition to sustainable economic and environmental development in Germany, Europe and worldwide. To support this process of transformation, it provides individual medium and long-term financing solutions, especially for future technologies. In so doing, KfW IPEX-Bank fosters advances in technology, with the aim of improving economic, environmental and social conditions around the world through transformation of the economy and society. Environmental and climate protection projects across all sector departments totalled EUR 2.9 billion (17% of commitments).

KfW IPEX-Bank works globally to support implementation of the Agenda 2030 adopted in Paris in 2015 and its 17 sustainable development goals (SDGs). In addition, the bank complies with the Equator Principles and the OECD's ECA Common Approaches. It also incorporates its own extensive appraisals into its decision-making processes when lending, to verify that the conduct of its borrowers is environmentally and socially sound.

Economic and financial results

Despite the challenges posed by COVID-19, KfW IPEX-Bank can look back on a slightly positive 2020 financial year overall in economic terms. The operating result, mainly comprising net interest and commission income, developed very satisfactorily. This was contrasted, however, by an additional requirement for risk provisions, primarily in connection with the economic fallout of COVID-19 and individual loan defaults. On balance, this led to a slightly positive overall result for the reporting year, which may be regarded as a satisfactory outcome given the challenges presented by the pandemic.

KfW IPEX-Bank GmbH is a legally independent and separate reporting entity which undertakes all export and project finance market transactions. In the past financial year it achieved operating income before risk provisions and valuations of EUR 243 million. Due to the impact of the coronavirus crisis, the valuation result significantly exceeded the planned figure and standard risk costs, resulting in a profit from operating activities before taxes of EUR 47 million.

KfW's Export and Project Finance business sector, which KfW IPEX-Bank manages, shows a similar picture. Operating income before valuations of EUR 540 million, after offsetting risk provisions and valuations, resulted in a contribution of EUR 99 million to the consolidated earnings of KfW. Therefore, even in a year of exceptional challenges triggered by coronavirus, KfW IPEX-Bank remains a key source of revenue within KfW Group, and thus contributes to ensuring KfW's long-term promotional capacity.

The volume of lending of the Export and Project Finance business sector increased to EUR 67,5 billion at year-end 2020 (previous year: EUR 69.1 billion).

Legal notice:

The information contained in this online Annual Report 2020 is based on KfW IPEX-Bank’s Management Report 2020, which you can download here (in German, English version will follow soon). Should this online Annual Report 2020, despite the great care taken in preparation of its content, contain any contradictions or errors compared to the Management Report, KfW IPEX-Bank’s Management Report 2020 takes priority.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: kfw-ipex-bank.de/s/enxBk9hw

Copy link Link copied