The level of your current assets as a producer, processor or trader of raw materials/commodities fluctuates and shows peak demand. You may also be seeking to finance sales growth. Do you have unencumbered current assets (in Germany and/or abroad) and can you make them available as loan collateral? To achieve these aims, you want to find a suitable working capital credit line for yourself or your subsidiaries abroad that makes financial planning more reliable?

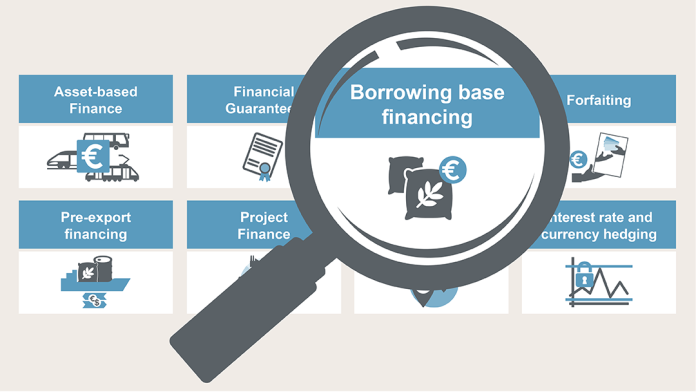

As a specialist financier, we offer you Borrowing Base Financing (BBF), a tailored credit line suitable for your international commodities trading activities. In particular, this form of financing with congruent terms tailored to your needs guarantees the degree of flexibility you need, especially in volatile raw material markets.

It can be used both bilaterally and as a syndicated loan. It offers scope for growth, be it organic or in conjunction with acquisitions.

BBF is tailored to your business model and to the specific market features of the commodities to be taken into account (e.g. crude oil, oil products, non-ferrous metals, cocoa or grains). It "breathes" to adapt to your needs and is structured along the value chain from the purchase of commodities to further processing, transport, storage and sale.

The BBF is collateralised by inventories of commodities and receivables resulting from the sale of commodities and, if applicable, other components. The maximum use of the credit line depends on the amount of collateral provided, which you usually report on a monthly basis. The lending limits individually agreed between us and you for the assets serving as loan collateral are taken into account here. The equivalent value of the collateral calculated this way forms what is known as the borrowing base. Depending on the country of storage and market conventions, it is necessary to regularly check the warehouse locations and inventories.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw-ipex-bank.de/s/enxBjBTI

Copy link Link copied