As a professional partner in the structuring process, we contribute to the success of your transaction with tailored financial models and customer-focused financial modelling consulting services.

Customers value our transparent and clear style of presentation as well as our practical recommendations on how to optimise the financing structure. We create our project finance and leveraged finance models in conformity with the highest standards of leading international banks in the area of project finance.

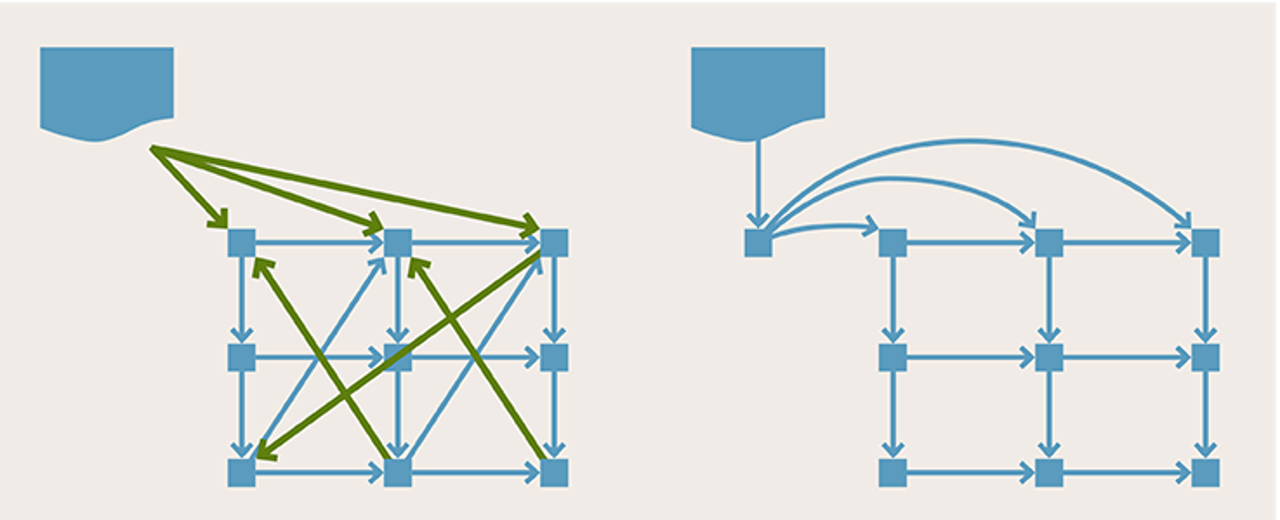

For our financial models, we have developed a clearly defined best practice standard that ensures well-structured and transparent models and keeps potential model errors to a minimum.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: kfw-ipex-bank.de/s/enxBjBS6

Copy link Link copied