KfW IPEX-Bank manages the CIRR Ship Financing Programme on behalf of the German Federal Government. The programme supports German shipyards in global competition and strengthens Germany as a shipbuilding location. Shipyards and industry suppliers together provide more than 85.000 German jobs.

Such programmes are common around the world including in France, Italy and Finland. With the consent of the German Government, KfW delegated this mandate to KfW IPEX-Bank’s Transaction Management department on the basis of its expertise and many years of experience in ship financing.

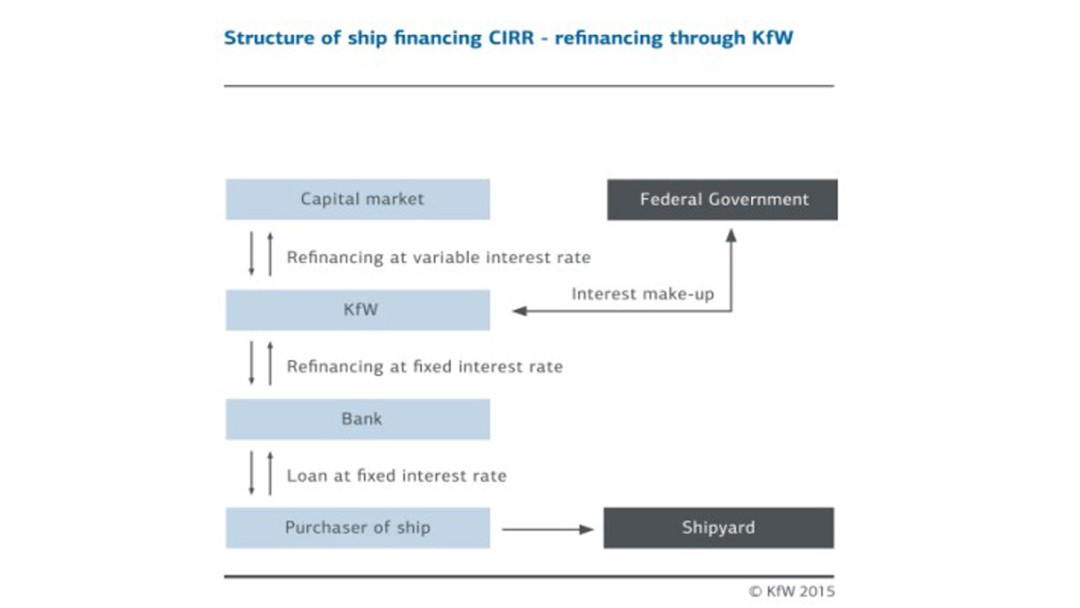

Under the CIRR Ship Financing Programme, buyers of ships receive a fixed-rate loan based on the CIRR interest rate (CIRR stands for "Commercial Interest Reference Rate"), which applies for the entire tenor of the loan. This minimum interest rate is prescribed by the OECD for officially supported financings in order to ensure competitive neutrality. To qualify, buyers must order the ships and/or ship components from a German shipyard.

For the financing bank, the CIRR Ship Financing Programme offers the following incentives: First, the interest rate risk of the loan is borne by the Federal Republic for the entire term. Second, this programme enables the bank to access favourable refinancing from KfW without putting a strain on its own liquidity. This possibility to refinance with KfW is considered the usual case by the Federal Government and is exercised by most banks. Interested banks can inquire about the terms and conditions applicable to refinancing solely by contacting the Ship CIRR Desk.

The experts staffing KfW IPEX-Bank’s Ship CIRR Desk advise shipyards, financing banks and shipping companies already in the pre-financing stage. They review the applications and conclude interest make-up and/or refinancing agreements.

Feel free to contact us by e-mail at:

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: kfw-ipex-bank.de/s/enxBi-c4

Copy link Link copied