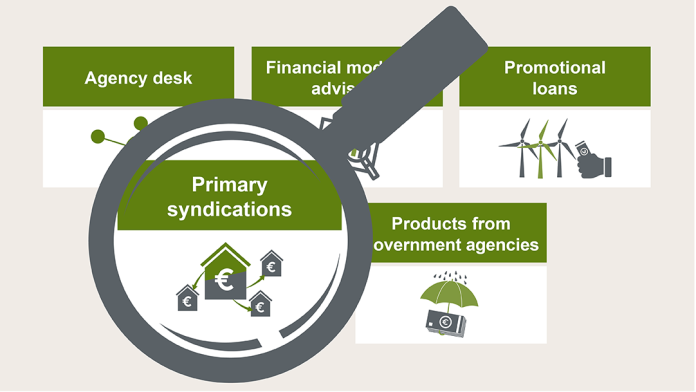

Primary syndications is defined as the structuring of a financing such that portions of the overall financing package can be placed in the loan markets with other financiers within an agreed time frame. The primary syndications always takes place on behalf of and in consultation with the borrower and may be carried out by one (sole arranger) or several arrangers in a coordinated manner (joint arrangers).

Together with the respective sector specialists, we structure and arrange the syndication of complex transactions with the aim of making them attractive for a large number of market participants and thus enabling the placement of large-scale deals in the market.

We guide our customers through the entire syndication process – from the start of structuring through to the successful conclusion of the financing.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: kfw-ipex-bank.de/s/enxBjBS8

Copy link Link copied