How we finance the future

Business development in 2021

The past financial year of KfW IPEX-Bank was again dominated by the ongoing pandemic situation. While there was a global recovery from the first year of coronavirus thanks to solid economic growth, a mixed picture emerged for individual industries and service sectors, and hence also for the investment assets financed by KfW IPEX-Bank.

Demand for loans in the passenger transport and tourism sectors, such as in cruise shipping and aviation, has declined significantly. Financing of industrial projects has been postponed, for example due to supply shortfalls in raw materials and intermediate industrial goods, as has financing for projects to secure raw materials. Demand for financing for infrastructure projects, especially in the digital sector, has remained stable.

New commitments by sector department

By focusing on long-standing customers and structuring financing that is backed by sound collateral, KfW IPEX-Bank was able to provide new commitments totalling EUR 13.6 billion. As a result, KfW IPEX-Bank's business operations remained stable, primarily thanks to its focus on future technologies. Of these new commitments, EUR 13.0 billion (2020: EUR 15.9 billion) related to original lending business and EUR 0.6 billion (2020: EUR 0.7 billion) to funds for bank refinancing under the CIRR ship financing, ERP CIRR export financing and Africa CIRR export financing programmes. All of KfW IPEX-Bank’s sector departments made an important contribution to the bank's result. The Power and Environment sector department booked the largest volume of new commitments at EUR 2.6 billion, issuing a significant proportion to projects relating to the energy transition, such as onshore wind farms and alternative energy production initiatives. These projects underline KfW IPEX-Bank’s ambition to support global climate policy goals.

In most cases, KfW IPEX-Bank acted as a partner in club or syndicate financing arrangements with other national and international banks. The bank takes on leading roles, actively involving other banks, institutional investors and insurance companies.

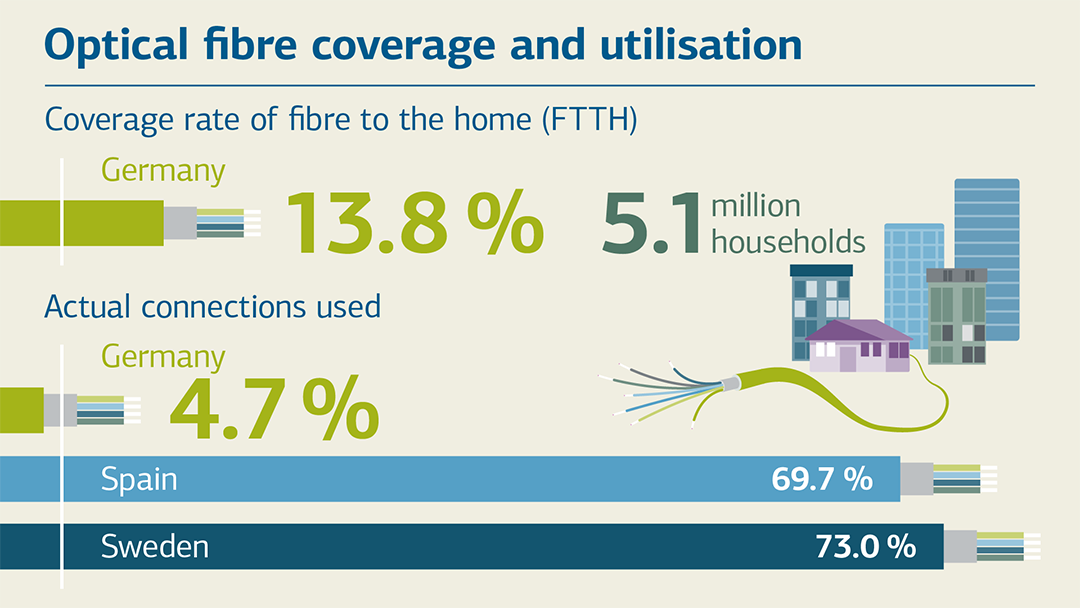

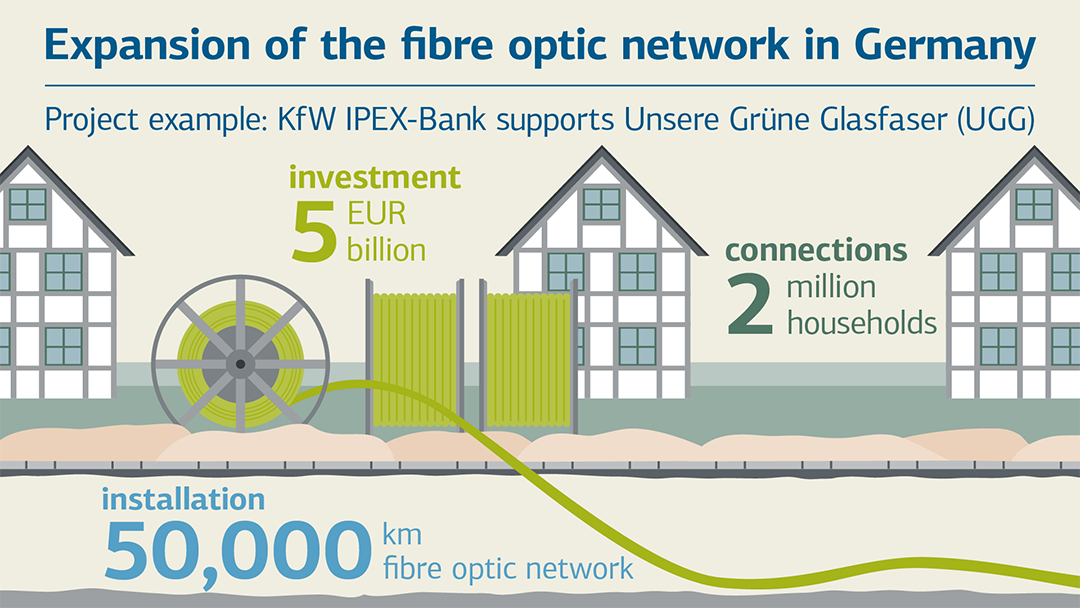

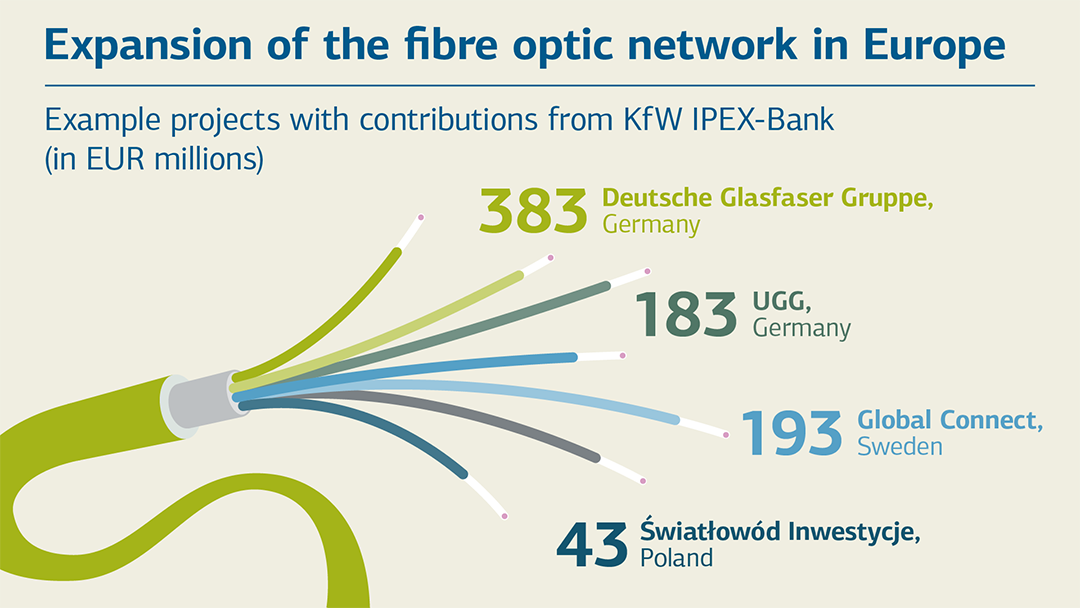

Fibre use and roll-out in Germany und Europe

Responsible action

KfW IPEX-Bank plays an active part in driving the transition to sustainable economic and ecological development in Germany, Europe and worldwide. Through its financing activities the bank fosters advances in technology, with the aim of improving economic, environmental and social conditions around the world through transformation of the economy and society. Environmental and climate change mitigation projects across all sector departments totalled 15% of commitments.

The sector guidelines for CO2-intensive sectors, which were implemented during 2021 as part of the group-wide tranSForm project, ensure that from 2022 onwards, new business concluded by KfW IPEX-Bank in these sectors will be fully compatible with the goals of the Paris Agreement. Further sector guidelines are currently being developed. With the help of external consultants, a greenhouse gas accounting system is being established by working groups across KfW and within KfW IPEX-Bank. Implementation of the new system is expected to take place in 2022, probably towards year-end. Moreover, we remain committed to the Agenda 2030 adopted by the United Nations and its 17 Sustainable Development Goals (SDGs). Information on our commitment to social responsibility and how this is implemented can be found here.

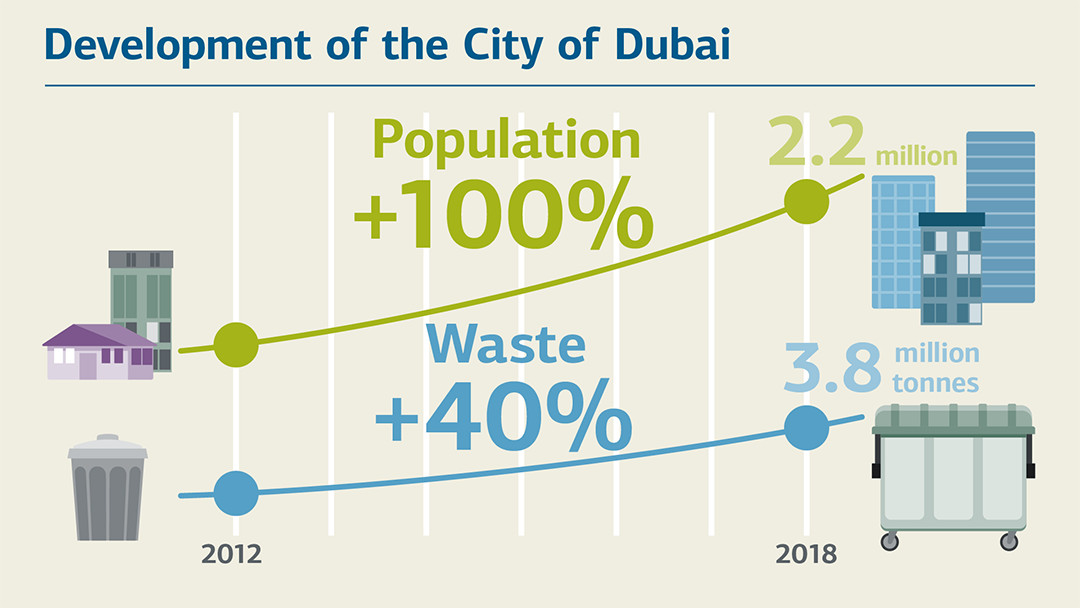

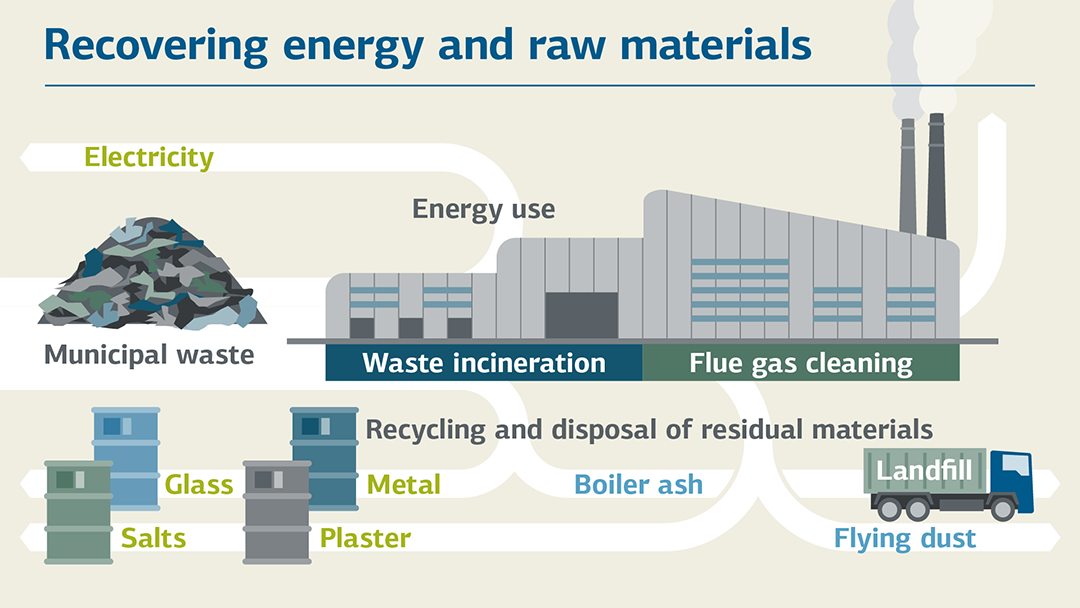

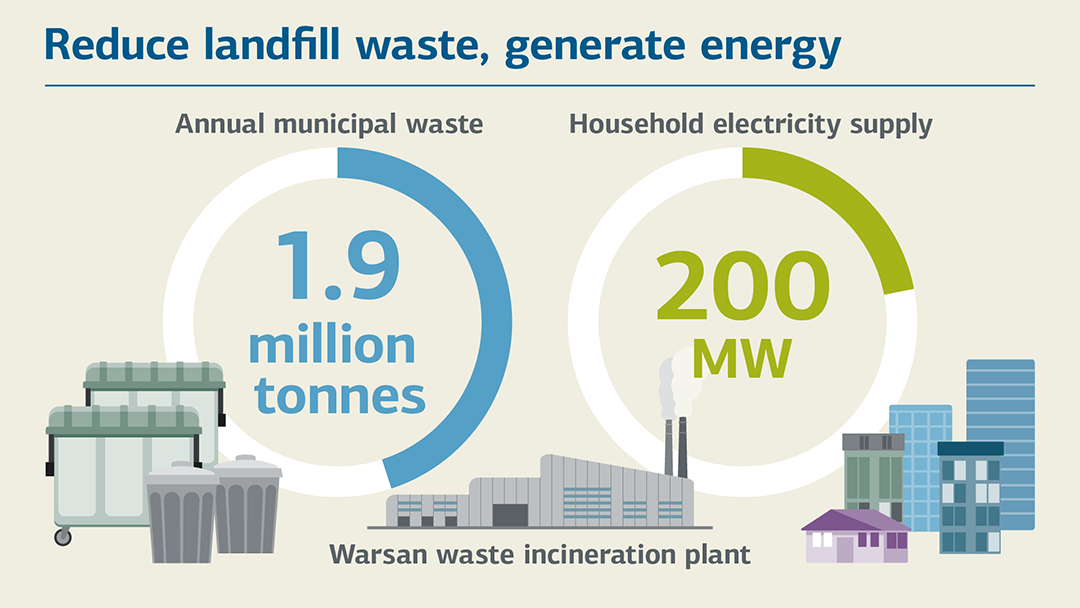

Waste-to-energy: a building block for the circular economy

Economic and financial results

KfW IPEX-Bank can look back on a solid financial year 2021 overall, which can be seen as a good outcome given the challenges presented by the pandemic. The operating result, mainly comprising net interest and commission income, developed satisfactorily. During the reporting year the requirement for risk provisions was smaller than in the previous year, which had been hit even more strongly by the economic fallout of coronavirus and individual loan defaults.

KfW IPEX-Bank GmbH is a legally independent and separate reporting entity which undertakes all of the Group’s export and project finance market transactions. In the past financial year, it achieved operating income before risk provisions and valuations of EUR 273 million, resulting in profit from operating activities before taxes of EUR 135 million.

KfW's Export and Project Finance business sector, which KfW IPEX-Bank manages, shows an even more positive picture. Operating income before risk provisions and valuations of EUR 540 million, after offsetting a net positive result from risk provisions in lending business and valuations, enabled KfW IPEX-Bank to contribute EUR 622 million to the consolidated earnings of KfW. Therefore, even in a year of exceptional challenges triggered by coronavirus, KfW IPEX-Bank remains a key source of income for KfW Group, and thus contributes to ensuring KfW's long-term promotional capacity.

The volume of lending of the Export and Project Finance business sector amounted to EUR 68.5 billion at year-end 2021 (previous year: EUR 67.5 billion).

Legal notice:

The information contained in this online Annual Report 2021 is based on KfW IPEX-Bank’s Management Report 2021, which you can download here. Should this online Annual Report 2021, despite the great care taken in preparation of its content, contain any contradictions or errors compared to the Management Report, KfW IPEX-Bank’s Management Report 2021 takes priority.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: kfw-ipex-bank.de/s/enxBldU2

Copy link Link copied