Responsible action

The growing frequency of extreme weather conditions around the world is clear evidence of the drastic consequences of climate change. The causes of these events are mostly man-made, and so tackling these root causes and committing to energy transition and a sustainable world are among the main challenges for our planet – and for KfW IPEX-Bank.

Tailwind for 'green' energy

The member states of the European Union (EU) have committed to cover at least 20% of their energy consumption from renewable sources by 2020. The EU also plans to cut greenhouse gas emissions by 80% compared to 1990 levels by 2050 – and KfW IPEX-Bank will actively support this process. It is already taking responsibility in supporting changes in energy policy for the benefit of the economy, society and nature. KfW IPEX-Bank therefore finances measures to increase energy efficiency and expand renewable energy sources, such as photovoltaic power systems and projects for harnessing onshore and offshore wind power.

Local action, global impact

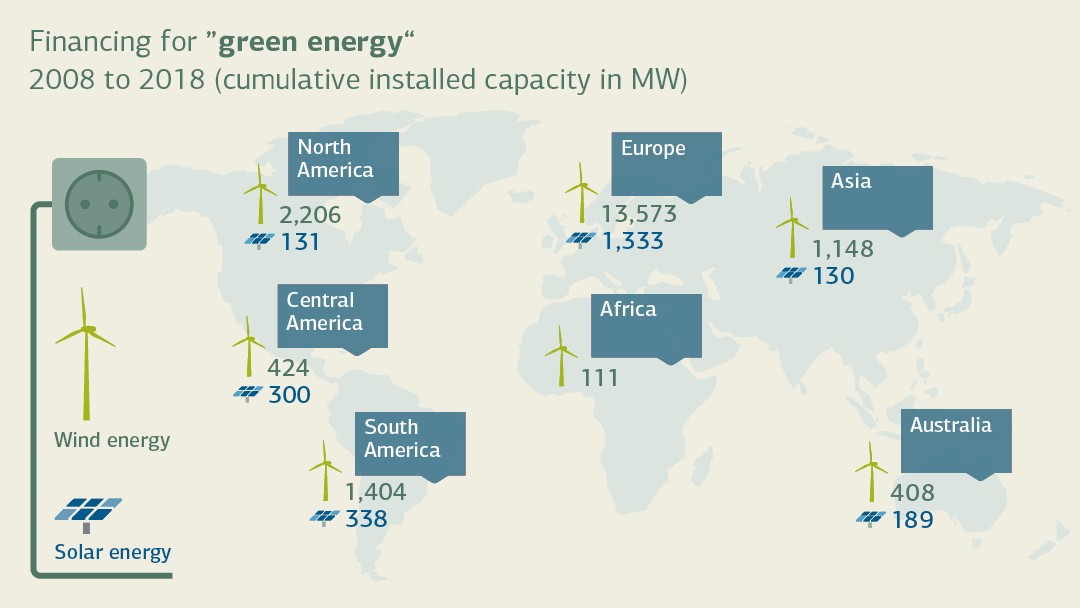

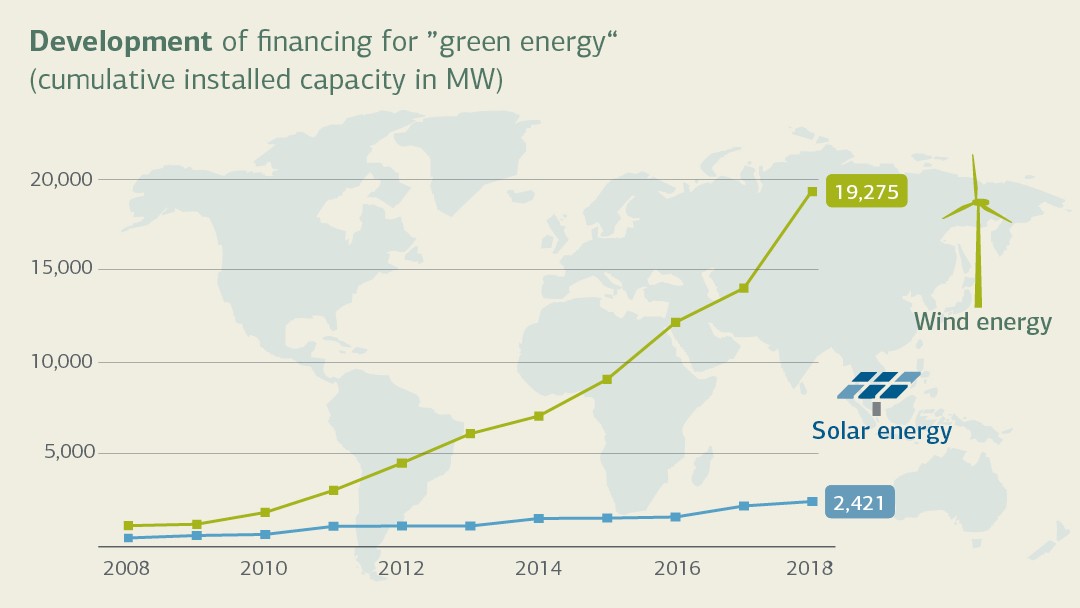

No matter where in the world measures are taken to expand renewable energy production and increase energy efficiency, they all have a positive impact on the global climate. KfW IPEX-Bank financed a number of renewable energy projects in 2018, including wind farms in Argentina with a share of exports originating from Germany or Europe. The Argentinian government introduced the 'RenovAR' programme back in 2015. The aim is that 20% of the country’s energy requirements will be covered by renewable energies by 2025, compared with the current figure of 2%. The 'Kosten', 'Pomona' and 'Malaspina' wind farms will contribute to achieving this target, supplying 24, 101 and 50 megawatts (MW) respectively.

In financing "green energy" KfW IPEX-Bank makes a significant contribution to global climate and environmental protection.

Reducing emissions with new technologies

KfW IPEX-Bank also focuses on financing measures to reduce emissions and increase efficiency. This is important, because the emergence of new technologies cannot currently keep pace with the rapid growth in global energy needs. Until energy production from renewable sources can cover electricity requirements in full, in terms of both total quantity and availability at different times of year and day, existing propulsion and generation methods will need to be upgraded and modernised to create modern bridging technologies. As such, KfW IPEX-Bank also focuses on financing sustainable measures in maritime industries. For example, it supports projects to retrofit ships with exhaust gas purification systems. It also finances newbuilds powered by LNG, the use of which in the shipping industry is much less polluting than the heavy fuel oil that is often used today, representing a key intermediate step towards green shipping.

More sustainable scrapping of ships

The Responsible Ship Recycling Standards (RSRS), which KfW IPEX-Bank joined in 2018 as the first German bank, have been drawn up along similar lines. The aim of the initiative is for minimum standards of occupational safety and environmental protection to be observed when scrapping ships.

KfW IPEX-Bank is committed to ensuring that clauses on scrapping in accordance with international standards are incorporated into loan agreements in the future. These clauses will also include an obligation for shipping companies to ensure that all vessels carry a 'Green Passport' that provides an overview of all materials used in building the ship. The RSRS initiative is an important measure with a view to making shipping greener and more sustainable.

Environmental and social impact assessment

In order to satisfy its own environmental and climate protection standards, KfW IPEX-Bank introduced environmental and social guidelines back in 2000, which it uses as a basis for all credit checks. KfW IPEX-Bank joined the Equator banks in 2008 and thus complies with a demanding set of regulations (Equator Principles), which are based on the World Bank Group’s environmental and social standards. Their aim is to make project finance socially and environmentally compatible, by means of measures including consulting persons affected on the ground, establishing a complaints mechanism and independent monitoring, and ensuring that the project prepares and observes an environmental management plan.

Legal notice:

The information contained in this online Annual Report 2018 is based on KfW IPEX-Bank’s Management Report 2018, which you can download here. Should this online Annual Report 2018, despite the great care taken in preparation of its content, contain any contradictions or errors compared to the Management Report, KfW IPEX-Bank’s Management Report 2018 takes priority.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw-ipex-bank.de/s/enxBjWww

Copy link Link copied